Sharing ministries are on the rise, but which one should you choose? With several options to choose from we will help you to find the best Christian healthcare alternatives for your family.

In this Samaritan Ministries vs MediShare comparison, we will be comparing two growing and popular options. We will go over price, deductibles, their statement of faith, and more.

Information about both companies

Samaritan Ministries

Samaritan Ministries was in 1994. Samaritan enables over 75,000 families to share medical needs in a biblical, non-insurance way.

Medi-Share

Medi-Share was founded in 1993. Their mission is to connect and equip believers to share their lives, faith, talents and resources with other believers. Medi-Share has over 300,000 members.

What are health sharing ministries?

Sharing ministries are not insurance companies. They are not tax deductible. However, they will save you thousands of dollars a year on healthcare. With a healthcare sharing ministry, you will share the cost of your medical bills among members of the ministry that you partner with.

Doctor visits comparison

Medi-Share

With Medi-Share you will be able to get virtual doctor visits for free with Telehealth. In under 30 minutes you will be able to receive a diagnosis and prescriptions from the comfort of your own home. This is extremely convenient because you can receive treatment for acne, headaches, allergies, infections, fevers, joint aches, insect bites, and more directly from your home. With Telehealth you will have virtual care 24/7.

For serious issues, you will have to pay a fee of around $35 at a doctor’s office.

Get pricing for you and your family with Medi-Share in seconds.

Samaritan Ministries

With Samaritan you will have to self-pay which means doctor visits are going to cost more. Samaritan steps in when you have more complicated issues.

In network providers comparison

Medi-Share

Medi-Share has millions of in networks providers for you to choose from. Medi-Share offers PPO providers which helps you to get discounted rates. You will not have an issue finding doctors in your area. For family doctors alone, I was able to find 200 providers in my area.

Samaritan Ministries

With Samaritan Ministries since you are going to self-pay, you are able to go to any doctor’s office. Keep in mind that you will have to pay out of pocket until your bill reaches a certain limit.

Pricing comparison

With both companies you will be able to save thousands of dollars a year on healthcare.

Medi-Share pricing

Medi-Share is easily the cheaper sharing Ministry. In fact, you may be able to get healthcare for as low as $30 a month. Prices can range anywhere from $30 a month to $900 a month. Pricing depends on your age, members in your household, and your annual household portion. The higher your AHP the less you will pay. A single 25 year old male with an AHP of 10,000 can get healthcare for $80 a month. Medi-Share members report average savings of over $4000 a year on healthcare. Medi-Share members are able to save up to 20% on their share amount by qualifying for Health Incentive. The only thing that you need to do is live a healthy lifestyle. Find out how much your rates will be in seconds.

Click here to see how much your rates will be with Medi-Share.

Samaritan Ministries Pricing

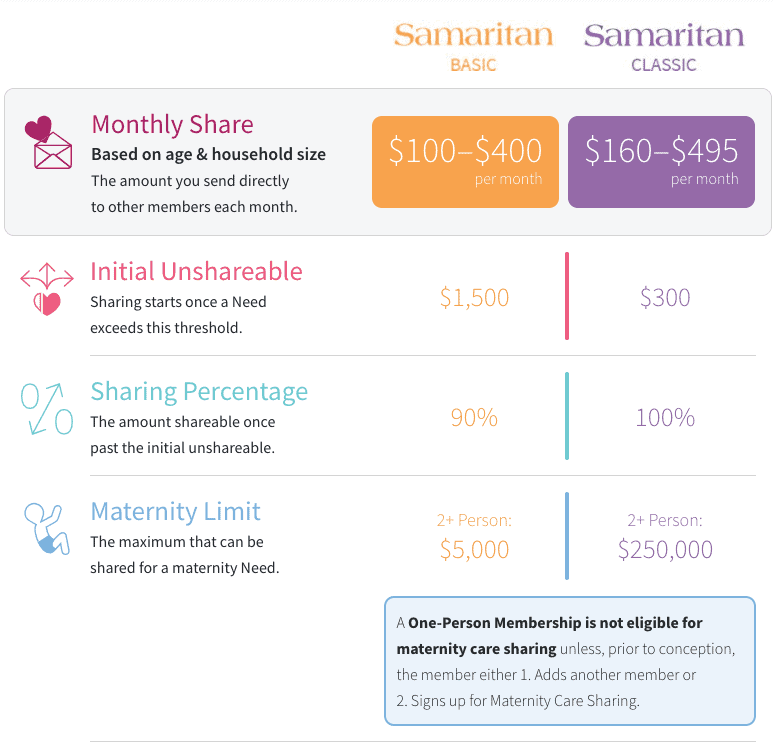

Although with Medi-Share you can save big, Samaritan offers more standard pricing. The cost of Samaritan Ministries dependent on your age and household size. Samaritan Ministries has two plans. Their Basic and their Classic plan. Their Basic plan costs anywhere from $100 to $400 per month. With the Basic plan you will have a sharing percentage of 90%.

This can be dangerous if you end up having a high bill. Not only will you be paying a deductible, but you might also have to pay an expensive bill. For example, if your hospital bill is $50,000, then you will have to pay $5000 out of pocket. If your bill is $100,000, then you will have to pay $10,000 out of pocket. If you have a $1,000,000 bill, then you will have to pay a $100,000 bill. As you can see, this plan can be risky if an emergency ever happens. The best option would be to choose their Classic Plan.

This can be dangerous if you end up having a high bill. Not only will you be paying a deductible, but you might also have to pay an expensive bill. For example, if your hospital bill is $50,000, then you will have to pay $5000 out of pocket. If your bill is $100,000, then you will have to pay $10,000 out of pocket. If you have a $1,000,000 bill, then you will have to pay a $100,000 bill. As you can see, this plan can be risky if an emergency ever happens. The best option would be to choose their Classic Plan.

The Classic Plan costs anywhere from $160 to $495 per month and you will have a sharing percentage of 100%. For needs over $250,000, you will be able to choose their Save to Share option for $133-$399 per year + a $15 annual administrative fee.

Deductible comparison

Sharing ministries are not insurance providers so there is no deductible. However, each company has something similar to a deductible.

Medi-Share has an Annual Household Portion or AHP. This is the annual amount of eligible medical bills that you must pay before your bills will be eligible for sharing. There are several AHP options ranging from $500 to 10,000. Medi-Share has higher deductibles than Samaritan. However, the higher your deductible the more you will be able to save.

Samaritan Ministries has an initial unsharable. Sharing will start when your need exceeds the amount of your initial unsharable. You will either have a $1500 or $300 initial unsharable depending on the Samaritan Ministries plan that you choose.

Discounts comparison

Samaritan works with EnvisionRx, which is a prescription discount service. Members will also be able to find discounted lab services through eDocAmerica.

With Medi-Share you will receive 20% by living healthy. Members will be able to save up to 60% on vision and dental. Members will also be able to save 20% to 70% on lab tests.

Get rates with Medi-Share here.

What don’t these companies cover?

- Abortion

- Pregnancy out of wedlock

- Medical emergencies resulting from an unbiblical lifestyle.

- Medical Marijuana

- (STD) Sexually Transmitted Diseases

Sharing limits comparison

Medi-Share limits

With Medi-Share there are no limits when it comes to your bill being shared. This is awesome because the last thing you want to be worried about in an emergency is that you have to pay extra money out of pocket. The only limit with Medi-Share is maternity which has an $125,000 limit.

Samaritan limits

Samaritan Basic has a max sharable limit of $236,500 and a $5000 2+ person maternity limit.

Samaritan Classic has a max sharable limit of $250,000 and a $250,000 2+ person maternity.

If you need a higher max sharable limit, then you will have to pay an extra yearly fee and a administrative fee.

Comparing the pros and the cons of each company

Pros

- Low monthly rates. With Medi-Share you might be able to save over 20% more than Samaritan Ministries.

- Millions of providers to work with.

- You will be able to text and interact with other members.

- Multiple discounts

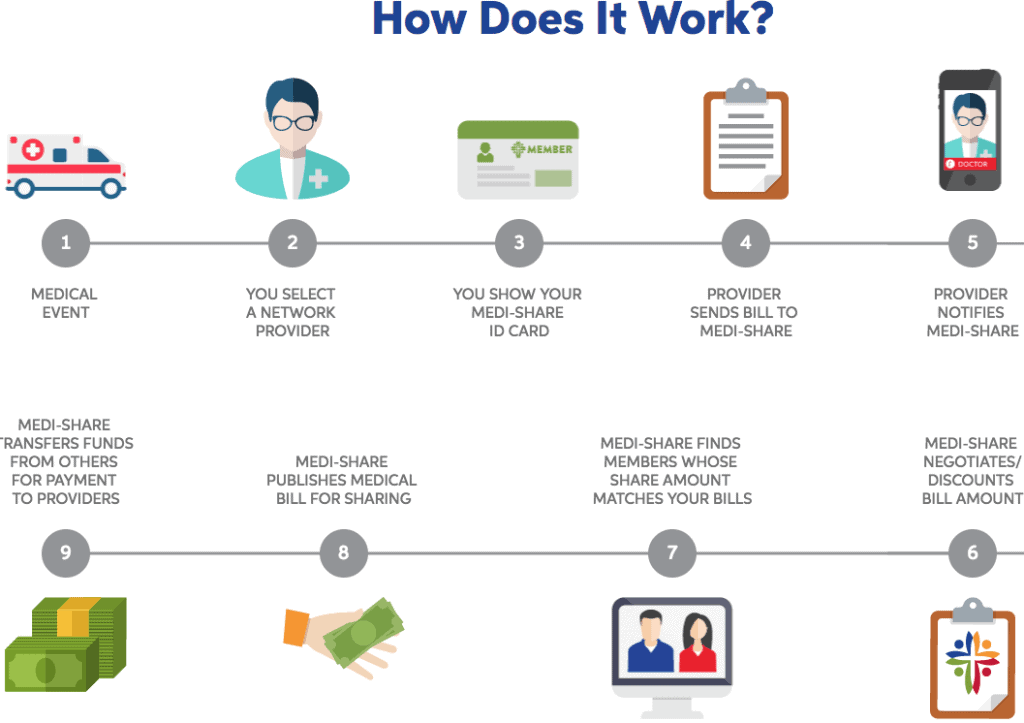

- Easy to use because your bill will be sent directly to Medi-Share.

- No sharable cap

- Growing rapidly

- free virtual doctor visits

- Low fee for in office visits

- Biblical

Cons

- High deductible options

Samaritan Ministries

Pros

- Low deductible amount

- Low monthly rates

- Biblical

- Patients can work with any provider.

- Growing rapidly

Cons

- You have to send in your bills which creates more hassle for the patient.

- There is a cap on how much is sharable.

- Sharing percentage on basic plan.

Better Business Bureau comparison

BBB gave Medi-Share an “A+” grade which reveals that they handle claims and customer complaints well. Samaritan Ministries does not have a BBB grade, but they are a BBB Accredited Charity.

Statement of faith and beliefs comparison

With both sharing ministries you must be a professing Christian. I compared Liberty HealthShare and MediShare. The top reason that I could not recommend Liberty was because their statement of faith was unbiblical. Use a sharing ministry that holds to the essentials such as Medi-Share and Samaritan Ministries. To qualify with both companies, you must believe the following:

- There is one God in three divine persons, Father, Son, and the Holy Spirit.

- Jesus is God in the flesh. He is fully God and fully man. He was born of a virgin. He lived the perfect life that you and I can’t live. He died to pay the penalty for our sins, He was buried, and He was resurrected on the third day.

- Salvation is by grace through faith in Christ alone. He has paid the price for our sins and He has made us right with God with His blood.

Qualifications

You must desire to perform out Galatians 6:2 “Carry each other’s burdens, and in this way you will fulfill the law of Christ.”

You must abstain from sexual activity outside of marriage.

You must not be involved in an unbiblical lifestyle. For example, members must abstain from marijuana, tobacco, and must not be involved in drunkenness.

Customer Support comparison

You can call Samaritan Ministries:

Mon, Tue, Wed, Fri:

8:00am – 5:00pm CST

Thur:

9:30am – 5:00pm CST

Samaritan Ministries has a large support center where you can receive answers to frequently asked questions. Here are a few popular questions that they answer.

“Is Samaritan Ministries’ health care sharing some kind of Christian health insurance?”

“If I have large amounts of medical expenses, how will that affect my membership?”

You can contact Medi-Share:

Monday – Friday, 8 am – 10 pm EST

Saturday, 9 am – 6 pm EST

They have a finance department, health and wellness, care management, cost management, human resources, and more.

I found that Medi-Share offers more helpful information for their members and those who are on the outside looking in. Medi-Share has a lot of videos, blog posts, tools and resources, and guides to help you to learn more about their program

Which healthcare option is better?

Both Medi-Share and Samaritan Ministries have their benefits and they both are biblical. However, Medi-Share won this comparison. Medi-Share allows you to save more. It is the easier company to use, especially when you have a medical emergency. With Medi-Share you will have free virtual doctor visits with top physicians all around the world. I also love how Medi-Share emphasizes encouraging, praying for, and building relationships with other members. See how much you can save with Medi-Share today.

Wow, I didn’t even know there were Christian health insurance companies, thank you for this , this is very informative, once again, thanks Fritz